Long Term Capital Gain Rate 2025

BlogLong Term Capital Gain Rate 2025. You only pay capital gains tax if you sell an asset for more than you spent to acquire it. What is the capital gains tax?

2025 Schedule D 2025 Capital Gains Tax Rates esme laurice, Capital gains arise from the sale of a capital asset like bullion, a house, a vehicle, heavy equipment, stocks, etc. Ltcg tax is a tax that investors need to pay on the profit generated from the sale of a capital asset held for a.

How To Calculate Long Term Capital Gains Tax (2025), For real estate and physical gold, you need to calculate the indexation benefit,. Rent income is taxable at slab rate.

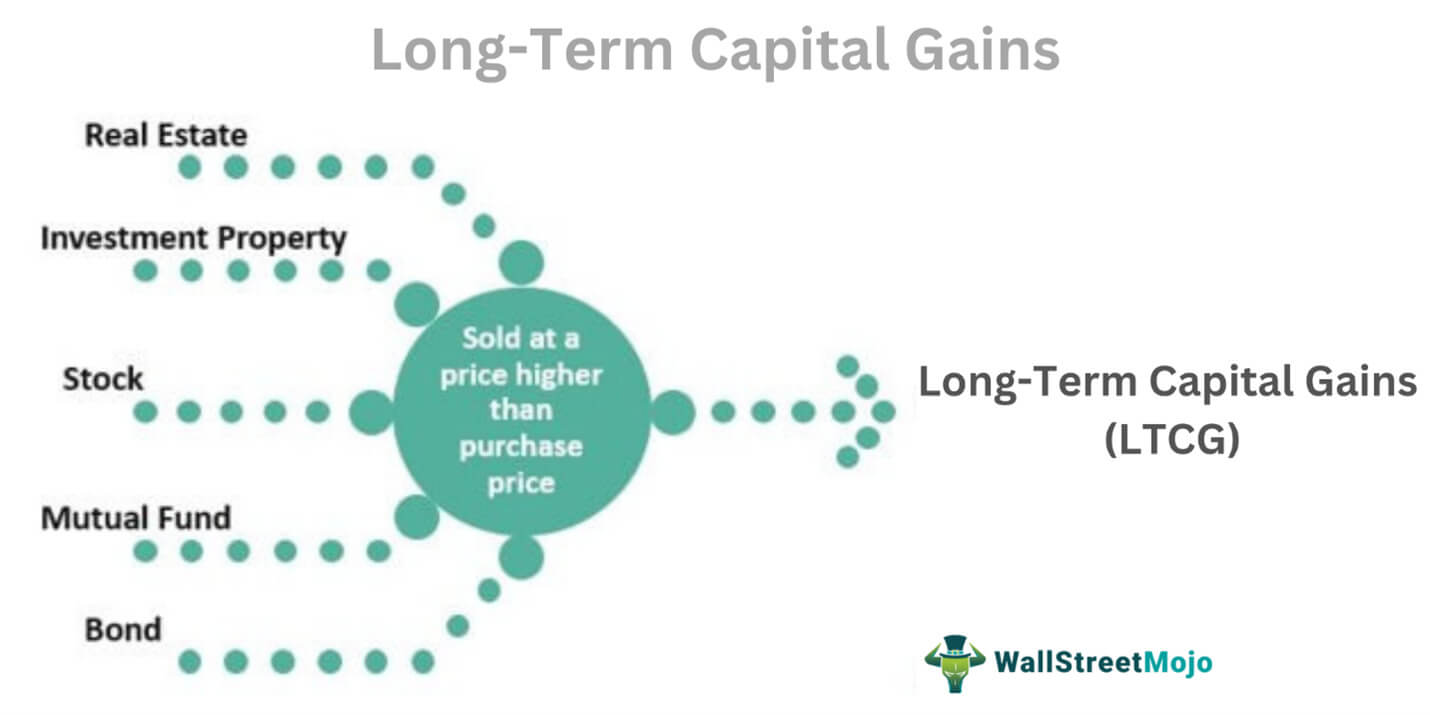

LongTerm Capital Gains (LTCG) Meaning, Calculation, Example, The capital gains tax is a type of tax you pay when selling a capital asset, such as real estate,. Written by true tamplin, bsc, cepf®.

ShortTerm And LongTerm Capital Gains Tax Rates By, A capital gains rate of 0% applies if your. How much you owe depends on your annual taxable income.

Capital Gains Tax A Complete Guide On Saving Money For 2025 •, Capital gains are the profit from selling an. Depending on your regular income tax.

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, 2025 and 2025 capital gains tax rates. The capital gains tax is a type of tax you pay when selling a capital asset, such as real estate,.

ShortTerm And LongTerm Capital Gains Tax Rates By, Nearly half a million families will gain an average of £1,260 in 2025/25 from this change, says the government. What is long term capital gains tax or ltcg tax?

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, The capital gains tax is a type of tax you pay when selling a capital asset, such as real estate,. Capital gains tax is levied on the profits gained from the sale of capital assets like mutual funds, shares, and property.

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, Depending on your regular income tax. March 14, 2025 12:16 ist.

Can Capital Gains Push Me Into a Higher Tax Bracket?, For real estate and physical gold, you need to calculate the indexation benefit,. Hence, the net capital gain is rs 63, 00,000.